The Digital Presence of The Top 10 Private Equity Fund Managers

Each year Private Equity International looks at the top 300 biggest private equity firms. To qualify for the 2024 rankings, firms needed to raise a minimum of $2.3bn in the past five years.

The top 10 GPs each raised more than $50bn in the past five years with the #1 (Blackstone) raising more than $123bn.

So what does the digital presence of GPs as sophisticated as this look like?

To find out, we’ve taken a look at:

The # of LinkedIn followers per firm (main social channel for private markets firms)

Their Pay-Per-Click (PPC) activity on Google

Their LinkedIn advertising - do they have an active advertising program (as of August 2024)

LinkedIn Followers

There are many ways to grow a LinkedIn company page (both organically and through paid advertising) so it’s near impossible to pinpoint how exactly a company has grown their follower count.

Using LinkedIn’s competitor page functionality (Analytics tab -> Competitors), you can see the amount of new followers gained in the past 365 days.

Blackstone and its senior executives are very active on LinkedIn. The company page garnered a whopping 343,241 followers in the past year (as of 14 August 2024) and Stephen Schwarzman, Chairman, CEO, and Co-Founder of Blackstone is listed as a top voice on LinkedIn.

The other top private equity firms have also gained a lot of new followers. While follower metrics are great to look at, we would recommend analyzing your follower demographic to see if the audience you’re looking to target is a part of that.

Demographics provided by LinkedIn include: location, company size, industry, job function, and seniority. They also allow you to see who exactly has followed your page by month.

Source: LinkedIn.com

Which Private Equity Fund Managers are actively advertising on Google?

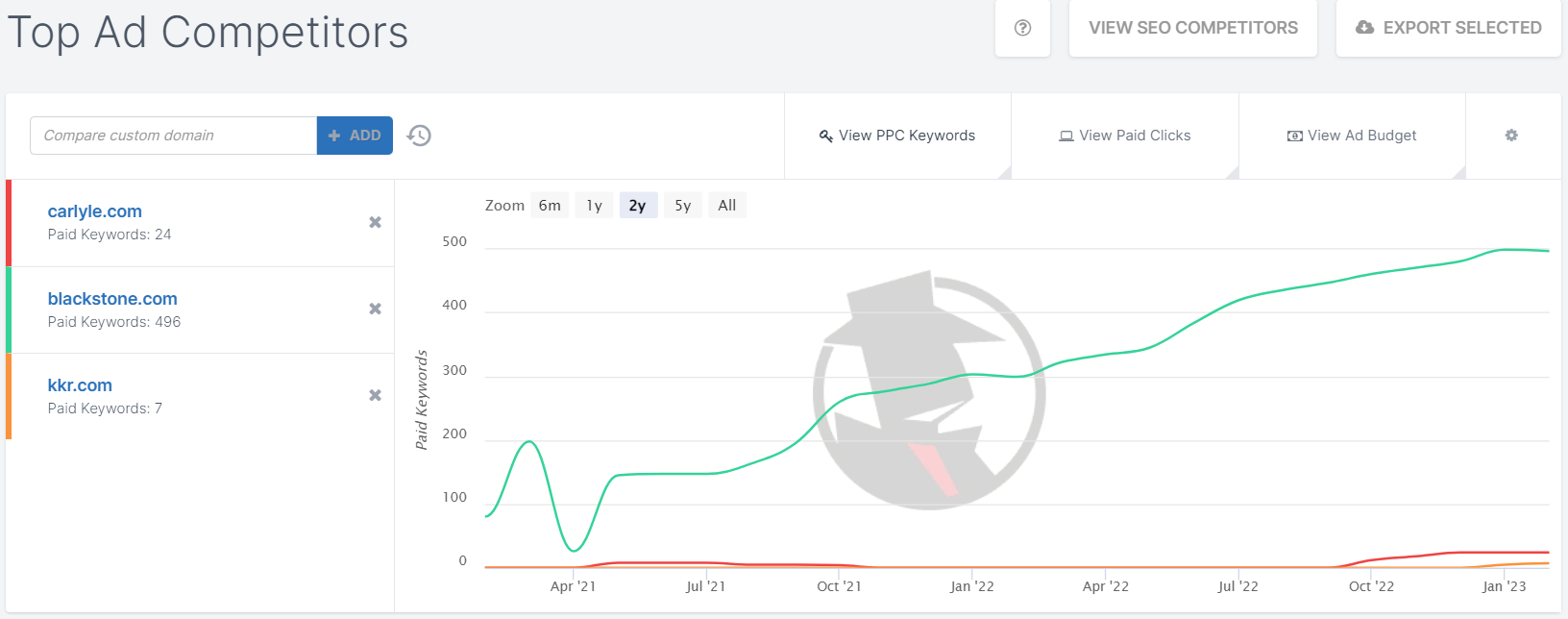

We used SpyFu to analyze the SEO rankings and PPC activity for the website domains used by the top 10 GPs and the results are surprising. 4 out of 10 GPs are running Google ads.

According to Semrush, one of the largest public SEO companies (used by >10m marketeers), there are four main types of keywords to classify intent:

Informational keywords — searchers looking for an answer to a specific question or general information.

Navigational keywords — searchers intending to find a specific site or page.

Commercial keywords — searchers looking to investigate brands or services.

Transactional keywords — searchers intending to complete an action or purchase.

Looking at Blackstone’s keyword bidding, they focus on two categories, informational and commercial.

Based on the SpyFu report, they are bidding on keywords related to private equity investing (informational) as well as branded keywords such as Blackstone Real Estate (Commercial).

Most advertisements were focused on financial advisors.

From capturing demand to generating demand - What does their LinkedIn advertising program look like?

Contrary to their paid search presence (or the lack thereof), 9 out of the 10 GPs are actively running LinkedIn ads.

Running an advertising program on LinkedIn makes sense as you can control who is seeing your ads by setting up an account or contact list. As the names suggest, these lists allow you to target specific companies and/or people.

While LinkedIn doesn’t enable you to see who a specific company is targeting with their ads, you can see which ads they are running, which we covered in a past article. Looking at the ads from the 10 GPs, they seem to serve five purposes (in order of most frequently displayed):

Driving awareness of asset class and/or strategy specific expertise

Most frequently used, sharing thought leadership with current and potential LPs is a great way to show what’s unique about your firm. People invest in people, a phrase you’ll have heard during your private equity career.

Recruitment for junior positions (incl. internships)

Many potential recruits are active on LinkedIn, as the platform is heavily used by professionals looking for their next step. The platform also allows you to target by seniority and focus on specific accounts.

3. Sharing event attendance

Attending a private equity event? Let the attendees know you’re attending. Be mindful of the minimum amount of contacts you can upload to LinkedIn Campaign Manager (300). Targeting accounts is a solution for this, however, when targeting institutional advisors you are often only looking to reach a small part of the organization (e.g. the investment team of a corporate pension).

4. Reaching potential portfolio companies

Illustrating how they’ve helped a company in a similar industry succeed helps build their brand in the space.

5. Tapping into new markets (e.g. targeting financial advisors with new solutions)

Several private markets firms who are now offering new solutions use LinkedIn to target new audiences. They often run video interviews with senior executives to raise awareness. LinkedIn introduced retargeting functionality where you can retarget people who have watched e.g. 25% of your video (as illustrated on the right).

Private Equity Marketeer Tip:

A quick way to see examples of what type of ads other PE firms are running is by navigating to their company profile's posts tab. Although not very noticeable, you are able to click on “View Ad Library” which will show you the ads the firm is currently running.

In today's digital age, most people start their search for information online, which makes it crucial for private equity firms to have a strong digital presence to capture their attention.

The largest GPs are shifting from mainly using traditional marketing methods to making digital marketing a big part of their strategy to help build credibility, trust, and authority for the firm.

Use the form below to receive the latest private equity marketing insights including digital marketing tips to your inbox every month.

The information provided on this website does not, and is not intended to, constitute legal advice, instead, all information, content, and materials available on this site are for general information purposes only. information on this website may not constitute the most up-to-date legal or other information. This website contains links to other third party websites. Such links are for the convenience of the reader, user or browser; we do not recommend or endorse the contents of the third-party sites.